An Idiot, Too…

Today’s publication has very little to do with Joe Biden, Anthony Blinken, and Jack Sullivan, but I just wanted to get us started on the right foot and say that they are losers and idiots.

I’ve never seen America frailer and more disrespected.

They must be trying to beat Obama and Woodrow Wilson for the most dangerous and reckless administrations to wear the “too big for them” shoes of leaders of the free world.

That’s enough ranting, though. Let’s switch gears to the lunacy of their actions that is helping make the rich much richer while keeping everyone else suppressed and treading water.

Our portfolios are absolutely on fire with most commodities soaring, Bitcoin breaking out, stocks at record levels, and real estate at all-time highs.

Courtesy: Zerohedge.com

What this chart must scream at you is that if you’re just investing in American excellence rather than fearing pullbacks, corrections, bear markets, and meltdowns, you’re doing your household and your legacy a big favor.

Nothing is truer than this statement.

When you think about the incompetence of the present administration, the lack of independent thinking, and the childish way in which the world’s most powerful men fear criticism, I am encouraged by the fact that the economy can thrive even with the worst American political disaster ever.

Stanley Druckenmiller’s profit-taking in NVDA stock (which I own shares of as well) indicates that the world’s top investors understand this is the time for commodities, and this chart should make you DROOL:

Courtesy: Zerohedge.com

Let’s talk about inflation for a moment. The Federal Reserve took interest rates higher than any hedge fund manager or economist predicted. In fact, it was taken much higher for much longer. Interest rates are now actually keeping inflation with us.

I can watch Taylor Swift in a full-length Netflix documentary for $15/month, but if I want to see a show, I’ll have to pay hundreds or thousands of dollars.

Service inflation is out of control. Go to Nike and buy a pair of tennis shoes for $100-$200 but try to purchase seats to the U.S. Open and you’ll say goodbye to thousands of dollars.

Cutting interest rates will drive funds away from services and back to housing and goods for consumption. This will actually help, but I believe the FED will wait longer than needed.

Courtesy: Zerohedge.com

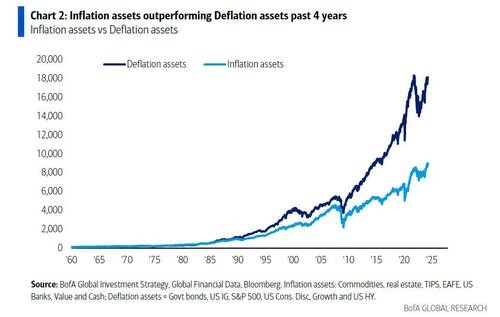

Meanwhile, inflationary assets are closing the gap from deflationary assets, but I’ll repeat my earlier point: think of all the insane governments that managed to make mistakes, yet owning assets is the BEST THING you can ever do! That’s irrelevant of inflation or deflation…

Read the full article here